British Gas Firm Sound Energy Faces Tax Setback in Morocco

The British gas exploration company Sound Energy has expressed concerns following the confirmation of a decision by the Moroccan tax authorities. It fears a risk of compromising the progress of its activities in Morocco.

"The Local Tax Commission (CLI) has confirmed the claims previously notified by the Moroccan tax authorities to the company, regarding taxes allegedly due under a tax audit carried out on Sound Energy Morocco SARL (SEMS) during the year 2021, covering the 2016 and 2017 fiscal years," the British gas exploration company announced in a statement. According to Sound Energy, the CLI confirms that certain alleged historical intra-group transactions between the subsidiary SEMS and Sound Energy Morocco East Limited (SEME) have taxable base values.

As a result, the company’s shares in Morocco fell 14% to 1.24 pence each in London last Wednesday. According to Sound Energy, the taxes on these base amounts would amount to $19.7 million, down from the $22.5 million estimate made in June 2021 due "solely" to exchange rate fluctuations. The Sound Energy company has 60 days to respond to accept or contest the CLI’s findings in Moroccan courts.

Reacting to the CLI’s decision, Graham Lyon, CEO of Sound Energy, said that "the tax authorities continue to hinder the company’s progress in Morocco, diverting its efforts from meeting Morocco’s need to provide gas to its power plants. One of the attractive features of Morocco from an industry perspective is its tax code promoting investment as set out in the Hydrocarbons Code, which includes a 10-year corporate tax exemption for upstream producers, as well as clearly defined exemptions from import duties and VAT.

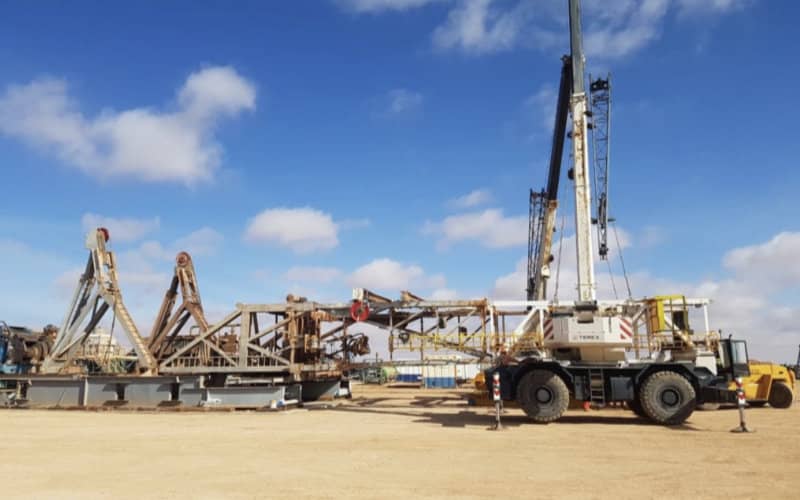

"With Sound Energy deeply in the development of its micro-LNG project and on the verge of completing a major pipeline, these events compromise their successful business," he added.

Related Articles

-

Café Controversy: Customer Sues Over Forced Second Drink Policy in Mohammédia

8 September 2025

-

Air Arabia Chaos: Stranded Passengers Miss Funerals and Hospital Visits as Flight Cancellations Spark Outrage

7 September 2025

-

Morocco’s Real Estate Paradox: Soaring Prices Defy Official Data, Crushing Home Ownership Dreams

6 September 2025

-

Morocco’s Foreclosure Crisis: Social Media Auctions Mask Rising Family Evictions

6 September 2025

-

Morocco’s Construction Boom Faces Labor Crisis: World Cup Projects Strain Housing Sector

6 September 2025